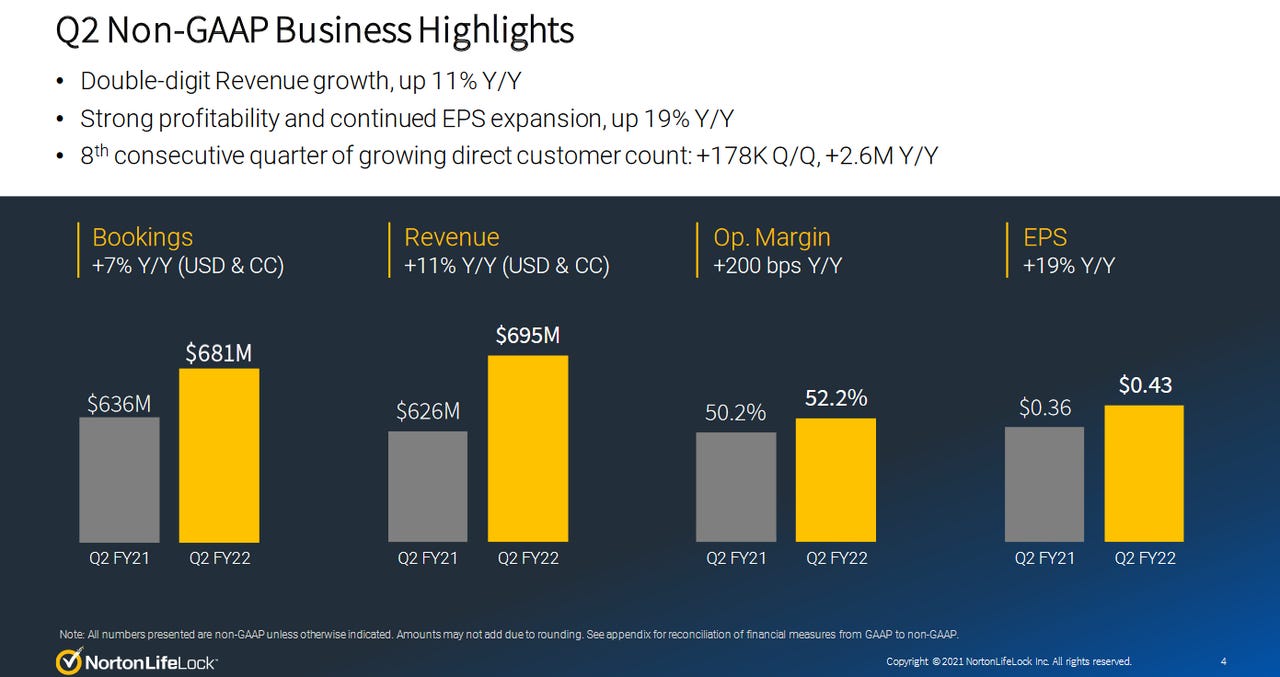

Cybersafety vendor NortonLifeLock on Thursday published its second-quarter financial results, reporting double-digit revenue growth and its eighth consecutive quarter of sequential customer growth.

Additionally, NortonLifeLock shareholders voted on Thursday overwhelmingly to support the company's proposed merger with Britain's Avast PLC.

NortonLifeLock's non-GAAP diluted EPS was 43 cents on revenue of$695 million, up 11%.

NortonLifeLock

NortonLifeLock Analysts were expecting earnings of 42 cents per share on revenue of$695.3 million.

The company's direct customer count in the quarter came to 23.3 million, up 2.6 million. Its customer count has grown every quarter since it was separated from Symantec, the enterprise security business that Broadcom purchased in late 2019.

"When we became a standalone company, we said our focus is to make cyber safety available to as many people as possible," CEO Vincent Pilette said toZDNet. "There are 5 billion internet users, not all of them consciously protected against cyber-criminality... When you sum up people who consciously paid for cyber safety, we have less than 5% penetration. And so it's a long journey for us, and we're excited to go and tackle that big problem."

To grow its customer base, NortonLifeLock six months ago acquired Avira, which offered a freemium model, with the idea to make freemium versions of all of NortonLifeLock's products available to all Internet users. In August, the company announced its proposed merger with Avast, significantly expanding NortonLifeLock's geographic footprint.

In the meantime, NortonLifeLock reported Q2 bookings of$681 million, up 7%.

The direct average revenue per user was$8.85, up from$8.80 the prior quarter and down from$9.10 a year prior.

While the pandemic has driven up consumer awareness about cybersecurity, Pilette said that at this point, "our goals came down a little bit closer to normal," with more seasonality driving sales. After a slower summer, Pilette said the company saw September finish on a "very strong note," indicating the interest in cyber safety is still growing.

For the third quarter, the company is expecting revenue in the range of$695 million to$705 million. Non-GAAP EPS is expected to be in the range of 42 cents to 44 cents.

NortonLifeLock also said Thursday its board of directors has declared a quarterly cash dividend of$0.125 per common share to be paid on December 15.

Etiquetas calientes:

tecnología

seguridad

Etiquetas calientes:

tecnología

seguridad