HP's future growth plans will depend on hybrid work, a world where every person has a PC, printing subscriptions and using 3D printing systems to make packaging more sustainable.

The company outlined its growth initiatives on its 2021 Securities Analyst Meeting.

HP reiterated its fiscal 2021 outlook given on its third quarter earnings call and projected non-GAAP 2022 earnings of$3.86 a share to$4.06 a share. HP also raised its annual dividend 29% to$1 per share and said it will return 100% of its fiscal 2022 free cash flow to investors via dividends and share repurchases.

Throughout HP's analyst day on Tuesday, CEO Enrique Lores and team emphasized that the company was strengthening its core PC and printing business, streamlining and creating growth via trends like 3D printing, hybrid work and digital services. "A strong HP has a strong core," said Lores.

Here's a look at HP's master plan to digitally transform.

HP's PC leadership in commercial and consumer laptops is strong and the company plans to keep it that way by blurring lines between work and play and making it easier for IT departments to manage devices. Lores said:

We are seeing a profound shift in the role technology plays in people's lives. Traditional boundaries have been erased and work has forever changed, creating significant long-term tailwinds for our categories. The hybrid offices of the future will be more distributed. More than 2/3 of office workers expect to work from home 3 or more days per week next year. This aligns with the approach we're taking at HP, where a majority of employees will have hybrid roles. To prepare for this shift, many IT departments are planning to deploy multiple devices per employee. And they are exploring ways to enable workers to collaborate and praise remotely. This broad-based proliferation of devices is also driving demand for peripherals that create more immersive experiences.

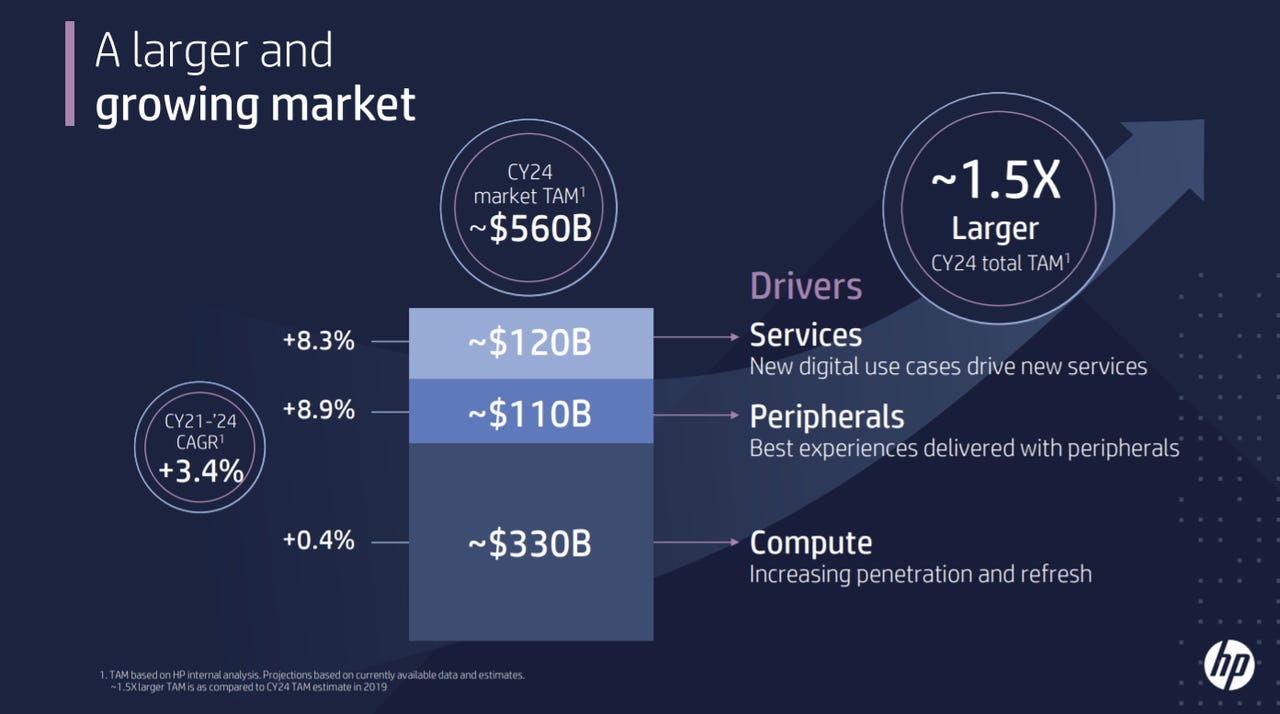

According to the company, the PC will serve as a key hub and HP's personal systems business will see its total addressable market grow to$560 billion by 2024. Video conferencing, retail point of sale, commercial and gaming will all drive PC upgrades.

Alex Cho, president of HP's personal systems unit, said the company plans on targeting high-value segments and on focusing on experiences. Cho added that the world is moving to 1 PC per person and the installed base is still dated. Windows 11 will also drive upgrades.

Peripherals will also be a large market to complement PCs.

On supply chain, Lores said HP is managing well and that advantage can also drive sales. Lores said:

We are developing more direct supplier relationships and long-term agreements for critical commodities. This is important so that we can orchestrate among suppliers in a more effective way. We have expanded supplier coverage in just the past few months, and we plan to continue doing so. Also, we have improved commonality of key parts and reduced unique components by up to 30%. We are going further and increasing design leverage between commercial and consumer products to reduce the number of unique platforms and displays.

HP is also optimizing systems and consolidated to 1 ERP system. The company also has leveraged data science and analytics to optimize its supply chain.

Printing habits have changed, but printers remain essential for home, work and school. In some ways, HP's printing business is going subscription. For instance, HP's Instant Ink subscription base tops 10 million and HP projects about$500 million in subscription revenue for fiscal 2021.

The COVID-19 pandemic slowed office and graphics demand, but that's rebounding, said Tuan Tran, president of HP's imaging and printing business.

Tran said:

Printing is essential at home for people to work, learn and create. Home printer sales were actually up. In fact, the home printer market grew by almost 3 million additional units in the first 3 quarters compared with the same period last year. This is despite a supply-constrained environment. Not only are people buying new printers. They're using their existing printers even more. Printing is also essential for business. As companies adapt to a new hybrid world, they're struggling to keep their workforce productive, and their information is secure. It's no surprise that 70% of IT decision-makers are placing a high priority on providing printers for their employees working remotely.

The moving parts for HP's printing business include:

On the services front, Tran said Instant Ink will move beyond ink to toner and paper. HP said almost half of its customers want to get their PC, printer, supplies and services consolidated into one monthly bill.

HP is also offering printers and supplies to remote workers via customized company portals and bridging into digital document workflow software.

HP has been relatively quiet on the 3D printing front as rivals such as 3D Systems, Stratasys, Desktop Metal and others develop markets. But HP has an interesting plan for its 3D printing business and is targeting unique markets such as the sustainable packaging market.

The company said that HP's 3D printing revenue has not recovered to pre-pandemic fiscal 2019 levels.

Didier Deltort, president of HP's 3D printing unit, said the company's goal is to disrupt large industries. HP's industrial thermoplastics printers have done well, and the company is targeting metal 3D printing at scale in 2022.

Deltort said one big initiative is to target the fiber-based sustainable packaging market. HP is hoping to use its 3D printing systems to replace more than 150 million tons of single-use plastics produced annually with fiber-based packaging that's biodegradable.

HP has removed 50% of its single use plastics from its personal system packaging and is currently working with food, beverage, cosmetic and dairy product companies on 3D printed packaging.

Another area for HP's 3D printers will be personalized health and wellness. Deltort said:

Custom body solutions like orthotics and prosthetics are an approximately$10 billion opportunity. We are entering this category with digitally manufactured custom orthotics. And we believe our solution is significantly more affordable, personal and convenient.

In addition, HP is targeting high-performance athletic footwear and has a personalized performance running midsole in development.

Etiquetas calientes:

tecnología

Hardware

Etiquetas calientes:

tecnología

Hardware