On Monday, Oracle shares fell in after-hours trading after the tech giant published mixed first-quarter financial results. Oracle failed to meet the market's revenue expectations. Still, Oracle touted its cloud growth, noting that its IaaS and SaaS businesses brought in 25% of quarterly revenue.

Oracle's non-GAAP net income was up 2% to$2.9 billion, with non-GAAP earnings per share reaching$1.03. Total quarterly revenues were up 4% year-over-year to$9.7

Oracle

Oracle Analysts were expecting earnings of 97 cents per share on revenue of$9.77 billion.

"Q1 results were excellent as constant currency revenue beat guidance by$100 million with all revenue segments exceeding forecast, and Non-GAAP earnings per share beating guidance by$0.08," CEO Safra Catz said in a statement. "Oracle's two new cloud businesses, IaaS and SaaS, are now over 25% of our total revenue with an annual run rate of$10 billion. Taken together, IaaS and SaaS are Oracle's fastest growing and highest margin new businesses. As these two cloud businesses continue to grow, they will help expand our overall profit margins and push earnings per share higher."

With an accelerating growth rate, Oracle's IaaS and SaaS businesses are expected to exit the fiscal year with a run rate in the mid-20s, Catz said on Monday's conference call.

Oracle Cloud Infrastructure (OCI) consumption revenue in Q1 was up 80% in constant currency, Catz said. Last quarter, Oracle founder and CTO Larry Ellison said that about half the workloads on OCI are Oracle Database while the other half is everything else.

Oracle's Cloud@customer revenue in Q1 was up 44%, while consumption was up over 150%. The hybrid product effectively brings all of Oracle's public cloud services directly to a customer's data centers.

"They take a while to set up," Catz said, because "we follow a very special security model." Once customers have it deployed, she said, "when they realize how incredible it is... It is a global product, it is completely differentiated, and it is very profitable for us."

Fusion ERP cloud revenue was up 32%, while NetSuite ERP cloud revenue was up 28%.

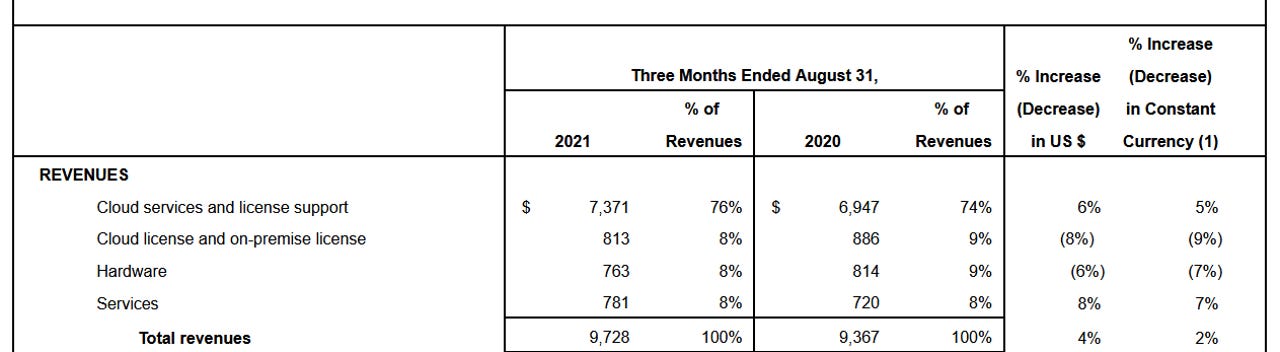

By segment, cloud services and license support revenues in Q1 were up 6%, reaching$7.4 billion. Within that category, applications cloud services and license support brought in$3.04 billion, up 8%, while infrastructure cloud services and license support brought in$4.3 billion, up 5%.

Cloud license and on-premise license revenues were down 8% to$813 million. Hardware brought in$763 million, down 6%. Services brought in$781 million, up 8%.

On Monday's call, Ellison highlighted Oracle's cloud ERP business, noting new financial services and healthcare customers.

"Banking and healthcare will be Oracle's two largest verticals going forward," Ellison said.

In Q1, a major portion of Bank of America went live on Oracle Fusion ERP, consolidating ledgers from 33 separate countries into one global cloud ledger. Also, in Q1, Vanguard, the largest global mutual fund provider, went live with Oracle Fusion ERP. In healthcare, Humana went live on Oracle's ERP.

For the second quarter, Catz said Monday; total revenue is expected to grow 3% to 5%.

Meanwhile, Oracle's board of directors declared a quarterly cash dividend of 32 cents per share of outstanding common stock.

Etiquetas calientes:

innovación

nube

Etiquetas calientes:

innovación

nube