Payments pioneer Square this afternoon reported Q3 revenue that missed expectations by a wide margin, profit per share that was a penny shy of expectations, and a dramatic cooling in revenue attributable to Bitcoin.

Square said its revenue from Bitcoin rose 11%, year over year, to$1.81 billion. That was lower than the prior-quarter total of$2.72 billion, and much lower than the 200% growth in Bitcoin revenue in Q2.

The report sent Square shares down 3% in late trading.

CEO and co-founder Jack Dorsey, and CFO Amrita Ahuja, said in prepared remarks in the company's shareholder letter that the company had "delivered strong growth at scale" in the quarter.

Square said its revenue in the three months ended in September rose 27%, year over year, to$3.84 billion, yielding a net profit of 37 cents a share, excluding some costs.

Analysts had been modeling$4.39 billion and 38 cents per share.

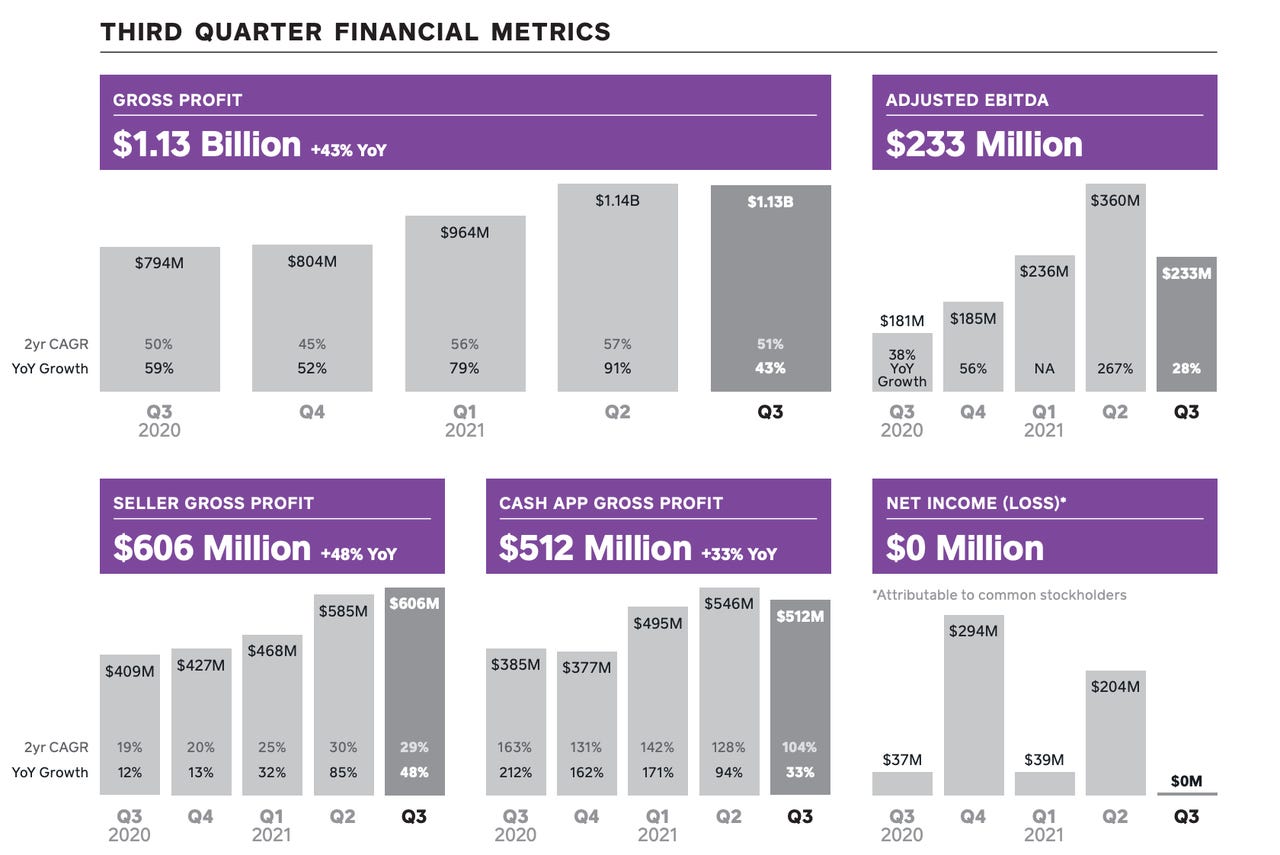

Square's gross payment volume, a measure of its business, rose by 43%, year over year, to$1.13 billion in Q3.

Without delivering a forecast, the company notes that "In October, we expect Seller to deliver strong gross profit growth year over year and on a two-year CAGR basis," adding,

Seller GPV is expected to be up 42% year over year in October, and the two-year CAGR is expected to be up 24%, a slight improvement compared to 23% growth in the third quarter on a two-year CAGR basis. GPV growth trends continued to vary by region, product, and vertical, depending primarily on differences in the timing and phases of reopenings.

For the company's Cash App, Square said,

In October, we expect Cash App to deliver strong gross profit growth year over year and on a two-year CAGR basis driven by growth in monthly actives, engagement across our ecosystem, and inflows into Cash App.

Square will hold a conference call with Wall Street analysts at 5 pm, Eastern time, and you can catch it on the company's investor relations Web site.

Etiquetas calientes:

finanzas

Etiquetas calientes:

finanzas