JAMES FIELDis speaking on this amazing IBC 2018 panel! (So are BBC, Google, & SSVC.)

To attend, login to your IBC registration, click on Upgrade, and use code CSS18 to get free 'add-on' access to the session.

NEW TV GROWTH MODELSis the topic of the panel. The set-up question: How will the TV industry reach the "next billion viewers" using broadcast and streaming tech? How will that impact business models?

I've had lively chats with James on this topic of late. I invite you to listen in:

BR: Hiya! The next billion? What's that about? Are we talking about more eyeballs or more pay TV subscribers or new business growth? We can take this in many directions.

JF: Ha! And indeed we will. Let's start out with the dollars and with some of our viewpoints on advanced TV advertising. There are a lot of low ARPU pay TV regions around the world and not everyone can afford$90/month for pay TV.

BR: Free ad-supported TV is of course massively important to the overall health of our business. But the ads are also a constant gripe, so one good question I'd ask is, what do you say to those that say we're really now living in a shift toward ad-free SVOD subscription models?

JF: We have to maximize the quality and effectiveness of those ads. It's all a question of how much money the viewer has, how much time they have, how annoying those ads are and how much they want to remove them. But I think while it's a constant gripe, as you say, mass audiences do appreciate free TV, so we just need to make sure those ads are relevant, not constant, and not annoying.

And that's what the future TV ad tech stack is going to help with. It'll help deliver more compelling ads because they'll be sourced from a wider variety of advertisers, the creative will be better and better targeted, and ultimately just like everything else, it will evolve.

BR: Right, but, here's one point, just as a Devil's Advocate, on targeted ads. The reality is that the advertising business is driven in large part by very large advertisers, and by macro-economic factors. For example, a major growth driver is when major new categories like pharmaceuticals, or fast-moving consumer goods, or mobile services spike upward. Right?

JF: Yes, it's true. You have 500 brands advertising on TV, I've heard 10 million or something doing video advertising on the web and then you have 2 million on social media. So while it's true that most of the money today in TV advertising is major categories of national or global advertisers, TV does have a huge opportunity to open up the top of inventory funnel to a much larger group of advertisers.

BR: Right, and that's where Google and Facebook really exposed an explosive ad market. They opened the market to literally millions of advertisers. Do you think advanced TV advertising will open the TV market to that extent?

JF: Maybe not as big as digital, but, a lot bigger than it is today. Partly that is because we are building infrastructure to deliver targeted ads, partly because programmatic exchanges, like for example what Google is doing, are maturing and getting better at trafficking the ads, and partly because we're getting better at measuring them. We will touch on all those items on this IBC panel.

BR: And what's great about being at IBC and talking about this is that there is another really critical component here, which is about "creative execution" -the ability to have high production value and compelling video spots at dramatically reduced costs compared to what it used to cost. That means that A, smaller advertisers can afford to make good-enough-for-TV spots, and B, equally importantly, larger advertisers can customize and sequence spots so that instead of viewers seeing the same spot fifteen times, maybe they see 3 spots 5 times each, and those are sequenced over a few weeks to tell a story.

JF: Yes exactly. So that's where TV advertising is going.

BR: That's exciting! But then let's bring it back down to earth here, because you mentioned targeting, you mentioned measurement, but we are living in a time when privacy seems to be back in vogue and with a vengeance. Data breaches, social platform hacks, GDPR, you name it.

How does that use of data to target TV ads square up with privacy? Are we going to be GDPR compliant? I mean obviously we have to be!

JF: Yes, and that's the beauty of it. We serve TV operators and telcos and ISPs and these are some of the largest firms within each of their respective markets. They are often regulated. They have to play by the rules. We will and we can serve targeted ads under all proper rules and regulations. And in fact our size and scale as a company will help us move our industry forward to achieve that.

BR: Will the panel get us caught up on the latest in ad measurement?

JF: We'll talk about it. Reliable measurement is still a gap. The way some of the digital firms count views is a fraction of the time we use to account for attention in the traditional TV business. There too, service providers can tie things together. They have more information available and they are experienced at handling it with strong integrity. So I see more opportunities for them in this area than perhaps other types of firms converging on similar opportunities.

BR: Cool, we've talked about the dollars, but what about the viewers? Where will the next billion viewers come from?

JF: China and India.

BR: Yes. Of course. But where else?

JF: Sounds like a job for some number crunching TV analyst.

BR: On it!

(beep beep beep whirrrr blip blip blip)

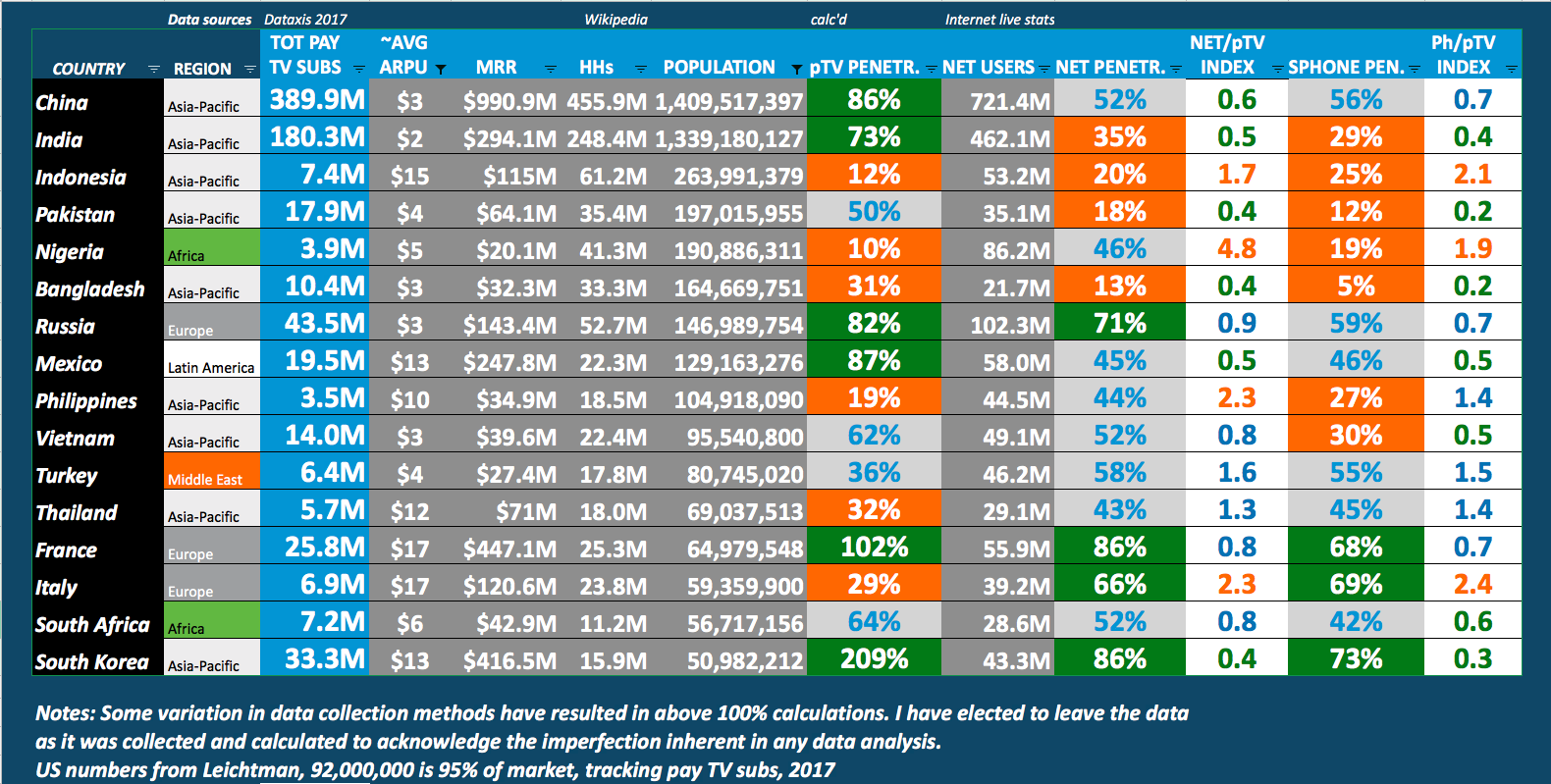

BR: OK! I'm back. This is a set of data on 57 countries including population, households, pay TV penetration, Internet penetration and Smartphone penetration. It also includes information on average revenue per unit (APRU) and total pay TV revenue for each country.

Here's a thumbnail view, since I can't distribute the entire sheet.

JF: Cool! So, can you send me a list of highly populous countries, with over 50,000,000 people, that also have low pay TV penetration rates of, say, under 65% HH penetration?

BR: You bet! Here it is:

JF: Ah, very cool. I see that some countries that have high internet penetration compared to their pay TV penetration rates. So we might guess that those countries may add more viewers using Streaming delivery models than Broadcast models?

BR: Possibly, yes. That was the idea behind those "index" calculations. Take the NET/pTV Index. Countries like Nigeria for example have much higher internet penetration than pay TV penetration. So one might guess that streaming methods could be a better way to get to the next billion in those cases. Now that's not necessarily the case, as I need to do more work to separate out satellite pay TV players since satellite infrastructure isn't the same as fiber or cable.

JF: Aha, okay, right. A work in progress. So then is Ph/pTV Index is where Smartphone penetration is much higher than pay TV penetration?

BR: Yes, Indonesia, Italy and Nigeria all have relatively higher smartphone penetration than pay TV penetration, suggesting that TV in those places will find the next billion via mobile streaming methods.

JF: And the other thing you can see, there are a ton of countries where the ARPU is really quite tiny.

BR: Yes. Here's another filter view, with countries that have populations above 50M, and ARPU below$20.

JF: So cool. Those countries need to boost value and pricing! Not to mention the opportunity for FMCG and Pharma to establish themselves as brand leaders to this new wave of consumers.

BR: Right, we have China, India, Indonesia, Vietnam, Russia, Mexico, Bangladesh, Pakistan, Turkey, Nigeria, France, Italy, South Africa, South Korea, Philippines and Thailand.

So maybe also those are countries, especially the more mature countries, where pay TV models might really need to amp up the advanced TV advertising stack in order to tap into some of that economic prosperity without raising prices too high for consumers in those markets.

JF: Very nifty. Hey, I think this is going to be a really fun IBC!

BR: And I think your panel is going to be really fun. Good luck my friend!

Book a demo with the Cisco SPVSS team at IBC by reaching out to James or Brian on LinkedIn.

Etiquetas calientes:

Service Provider

Video

Streaming

Pay TV

OTT TV

Etiquetas calientes:

Service Provider

Video

Streaming

Pay TV

OTT TV