Source: SoLo Funds

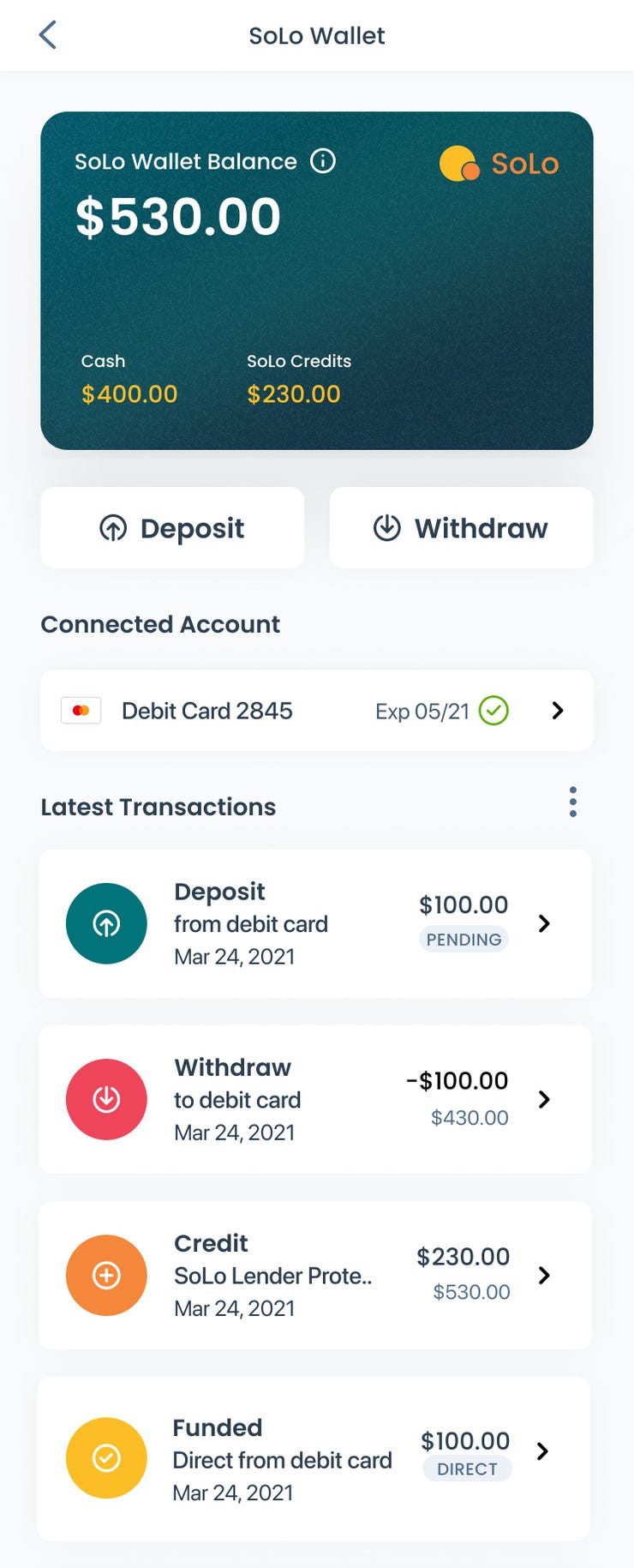

Source: SoLo Funds SoLo Funds announced Tuesday the release of its new digital SoLo Wallet. The wallet aims to make it easier for users to add funds to the platform to send loans and to have a secure place to access funds from a loan.

The wallet is designed to give lenders greater transparency with transactions and allow them to add and disperse funds easier. For borrowers, they can have a simpler time accessing funds and can use the wallet as a primary account with direct deposit and other standard consumer deposit account features.

With SoLo Funds, users can either request or fund loans of$50 to$500. Borrowers choose when they'd like to pay back the loan, as well as set a tip for the person funding the loan. According to SoLo, the average loan duration is 15 days with a max of 35 days. Borrower tips usually range from 3% to 10% of the loan.

According to the company, the average loan is roughly$240. So, the tip for such a loan could be anywhere from$7.20 to$24. Depending on the length of the loan (with a max of 35 days), it could be a worthwhile investment.

Users will first need to link their bank account and debit card to the wallet. They will then be able to deposit funds as they would a normal deposit account, and then they can use those funds to lend money to borrowers. Borrowers will be able to withdraw the funds received from lenders to their connected debit card.

The company has plans to add a debit card of its own, but for now, users will have to use one they already have. SoLo also plans to integrate features like early pay, interest-bearing accounts, and a credit builder tool in the coming months.

SoLo Funds is an innovative company looking to empower underserved communities and individuals who need emergency cash but can't go to a typical lender to get it, either due to poor credit, unfavorable terms, or other factors.

"With SoLo, borrowers set their own terms, including when they're going to pay [the loan] back and what they're ultimately going to pay for the loan," Rodney Williams, SoLo Funds co-founder, toldZDNet. "We wanted the borrowers to have all the power."

Together with co-founder and CEO Travis Holoway, Williams wanted to solve a problem they both noticed in their own communities. They realized a high portion of Americans were struggling to meet unplanned expenses and had few places to turn. "With that in mind, we really felt like, when we looked at the market, that no one provided a true solution to meet that need," Williams said.

According to the company, 82% of all members are from underserved communities. Over 60% of borrowers are women, 49% have a college degree, 22% are LGBTQ, and 16% have a disability. SoLo Funds has nearly 450,000 members, with over 300,000 SoLo Wallet accounts and 110,000 monthly active users.

"We wanted [SoLo Funds] to be community-driven. I grew up in communities where there wasn't a Chase Bank or Bank of America, but there were a lot of other things, like check cashing places. There was a lack of trust as it relates to financial institutions, so [SoLo Funds] wanted to remove them," Williams said.

He also said that when unplanned expenses arise, many people have few options to turn to for financial help. These include friends and family or payday loans, and when those don't work, some may resort to crime.

"We believe in solving real problems and creating trust with consumers. For us, a lot of the banking features we're releasing are designed to make borrowing and lending better and easier," he said.

SoLo Funds doesn't have a typical approval process. Users don't undergo a credit or background check, making it far easier to access funds than through a traditional lender.

Instead, users are required to connect their bank account and debit card, as well as establish Know Your Customer (KYC) and other anti-money laundering (AMI) practices with SoLo's financial service facilitators Synapse and Plaid. All three factors must be verified before you can start lending or borrowing through the app.

SoLo then creates a SoLo Score for the user by analyzing the past 24 months of their banking data. The score is highly influenced by the user's cash flow and transaction history. The SoLo Score will decrease and increase depending on how responsible the borrower is with the loans they request.

According to the company, this process works better than other alternative lenders, as it's seen a repayment rate three times higher than the industry average, with 9 out of 10 loans being repaid.

Users seeking to fund a loan can use the potential borrower's SoLo Score to determine if they'd like to take on the loan or not. Additionally, SoLo Funds provides lenders with the opportunity to enroll in Lender Protection. For a 5% fee, SoLo will protect your loan in the instance it's not paid back on time and will credit the full amount to your SoLo Wallet.

"As you can imagine, this is an investment like any other. So it has risks," Williams said. Users who don't pay back their loan are no longer able to use the app until it's paid, but their credit score won't take a hit. "We made a decision as a company to not negatively affect our borrowers' credit until we can positively affect it," he said.

But that doesn't mean there aren't things in place to dissuade loan delinquency. If the loan isn't repaid within the set time limit, SoLo will reach out, and the borrower can work with the company to make their payment. If the loan is repaid within 35 days, the lender receives the loan in full. Outside of the 35 days, the borrower is charged a late fee of 10% of the principal loan payable to the lender. However, according to its FAQ page, if the funds are recovered after 35 days, SoLo takes a 20% loan recovery fee.

If SoLo's team isn't successful in recovering the funds within 90 days, the case is transferred to its third-party debt collection partner, who charges a 30% fee for whatever funds they recover. Borrower's can return to the platform once the loans have been repaid.

While it does seem like a high risk, again, SoLo does offer Lender Protection to protect the loan for a 5% fee. Which, depending on the size of the loan, seems worth it to avoid the potential headache. There's also the SoLo Score system in place to help vet borrowers.

A big part of the marketplace is trust. By being incredibly borrower-centric, SoLo Funds hopes borrowers will realize they have far more to gain by paying the loan than by not paying.

"Even post delinquency, we stay connected to our borrowers' bank account, so we're still able to work with them [to avoid default]. It's one of the reasons our repayment rates are so high. We don't treat them like a lot of other lenders. We try to work with them," Williams said.

A large part of SoLo Fund's approach to lending also focuses on the financial literacy of its users. The app and website offer a number of modules designed to help educate users about financial topics.

SoLo is trying to bring financial literacy one step further than traditional banks. The company recognizes that, while banks do provide financial education resources, a lot of the things they teach consumers about may not be obtainable for every individual, especially for those in underserved communities.

"It's extremely hard when a bank doesn't give you a chance. People say, 'you teach me how to do all of these different things, but I can't get a credit card, or I can't get access to these products.' What [SoLo Funds has] figured out is how to give anyone access, and we're teaching them the cost of capital," Williams said.

Etiquetas calientes:

finanzas

Etiquetas calientes:

finanzas