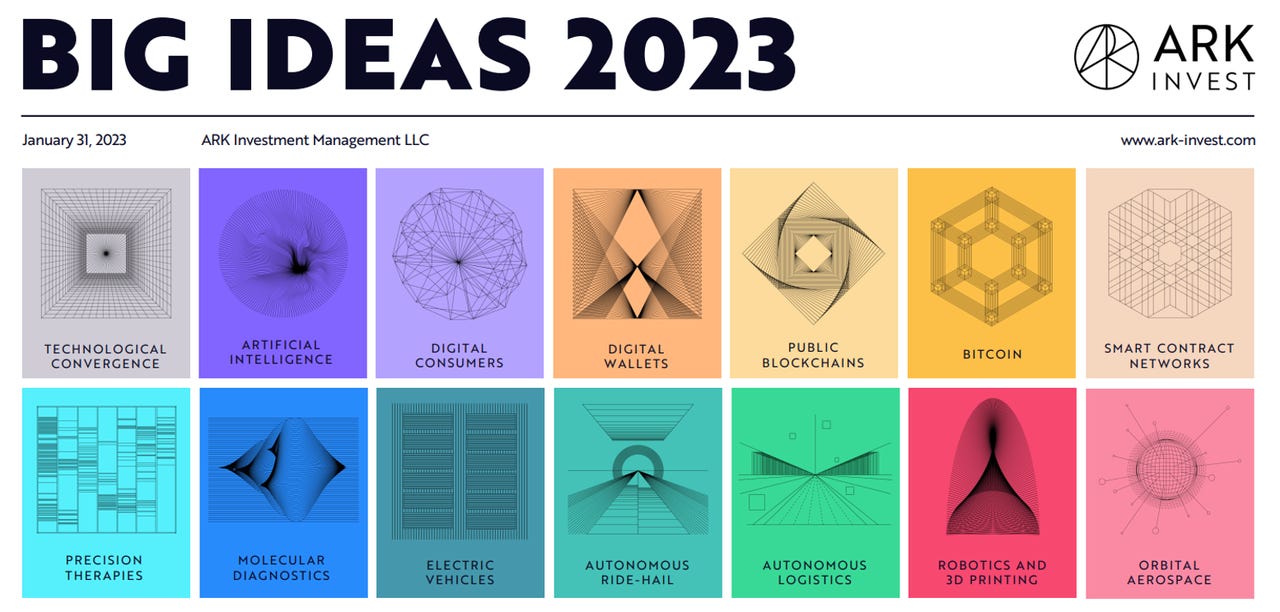

Ark Invest: Big Ideas 2023.

Ark InvestAccording to ARK Invest's research, five innovation platforms are converging to create unprecedented growth trajectories. Artificial intelligence is the most important catalyst, its velocity cascading through all other technologies.

The 2023 research from ARK suggests that the market value of disruptive innovation platforms could scale 40% at an annual rate during this business cycle, from$13 trillion today to$200 trillion by 2030.

To enlighten investors on the long-term impact of innovation, ARK Invest began publishing Big Ideas in 2017.

The annual research report seeks to highlight the technological breakthroughs evolving today and creating the potential for super-exponential growth tomorrow.

The five innovation platforms and technology catalysts cover the 14 big ideas in the 2023 report:

In this article I will provide an overview of the first four big ideas -- technical convergence, AI, digital consumer, and digital wallets.

According to ARK's research, five innovation platforms are converging to create unprecedented growth trajectories: Artificial Intelligence, Public Blockchains, Energy Storage, Robotics, and Multiomic Sequencing. Artificial Intelligence is the most important catalyst, its velocity cascading through all other technologies.

Also: What is ChatGPT and why does it matter?

The market value of disruptive innovation platforms could scale 40% at an annual rate during this business cycle, from$13 trillion today to$200 trillion by 2030. In 2030, the market value associated with disruptive innovation could account for the majority of the global equity market capitalization.

Autonomous Mobility Epitomizes The Convergence Among Technologies.

Ark InvestNeural Networks are the most important catalyst for technology convergence, followed by digital wallets, advanced battery systems, autonomous mobility, cryptocurrencies, intelligent devices, next generation cloud, smart contracts, reusable rockets, programmable biology, precision therapies, 3D printing, and adaptive robotics. For example, AI chatbots will 'drive' robotaxis, deep neural networks will enable more accurate long-read DNA sequencing, and robots will learn from experience thanks to advances in AI languages.

Robots Learn From Experience Thanks To Advances In AI Language Models.

Ark InvestHere are some of key forecasts from ARK's research regarding AI, including 2022 being the year of generative AI:

AI Is Increasing The Productivity Of Knowledge Workers.

Ark InvestARK highlights the key point of AI increasing productivity of knowledge workers by as much as 55% as it pertains to writing code. AI training costs are also expected to plummet at a whopping -70% per year. AI hardware and software costs should also continue to decline by 70% at an annual rate.

AI is creating explosive demand for training data. Generative AI algorithms depend on large-scale training data. Automation is also needed in order to utilize data and novel content that is created in real time. ARK's research notes that the cost to train the state-of-the-art GPT-3 in 2020 was$4.6 million. Based on our modeling, the cost of training an AI model with 57x more parameters and 720x more tokens than GPT-3 would drop from$17 billion today to$600,000 by 2030.

Also: I asked ChatGPT to write a WordPress plugin I needed. It did, in less than 5 minutes

For perspective, Wikipedia's 4.2 billion words today represent roughly 5.6 billion tokens. Training a model with 162 trillion words, or 216 trillion tokens, should be possible in 2030. In a world of low-cost compute, data will become the primary constraint. With sufficient training data, AI algorithms coupled with automation and real-time analytics, coding productivity could see a 10-fold increase. Cost declines should enable mass adoption of sophisticated AI chatbots.

AI Could Lead To A 10-Fold Increase In Coding Productivity.

Ark InvestAccording to ARK's research, AI should increase the productivity of knowledge workers more than four-fold by 2030. At 100% adoption, AI spend of ~$41 trillion could increase labor productivity ~$200 trillion, dwarfing the ~$32 trillion in knowledge worker salaries and rivaling current projections of global GDP in 2030. If vendors were to capture 10% of value created by their products, AI software could generate up to$14 trillion in revenue and$90 trillion in enterprise value in 2030.

In 2022, digital leisure spending* totaled$6.6 trillion and, during the next eight years, should grow 17% at a compound annual rate to$22.5 trillion adjusted for inflation. Four trends should contribute to its growth:

Artificial Intelligence Should Increase Time Spent On Digital Entertainment.

Ark InvestThanks to the productivity gains associated with generative AI, daily hours worked globally could decline 0.9% on average at an annual rate during the next five years, from 4.7 hours in 2022 to 4.4 hours in 2030, an accelerated decline from the -0.4% prior rate as of 2013. ARK believes that consumers will reallocate extra time to online instead of offline activities, increasing the share of total waking hours spent online from 39% in 2022 to 53% in 2030.

Also: How can generative AI improve the customer experience?

ARK research also forecasts that short-form video and recommendation engines will displace incumbent social media. The report found that in 2022, TikTok and Facebook were roughly equal in engagement hours, which could mark the peak in traditional follow-and-feed social media. Despite scaling faster than other social media platforms, TikTok accounted for only$10 billion, or 2% market share, of the estimated$470 billion spent on search, video, and social ads in 2022. Content-based social media is likely to capture advertising share more in line with its engagement hours.

Short-Form Video And Recommendation Engines Are Displacing Incumbent Social Media.

Ark InvestA big part of the digital consumer experience will be immersive experiences, especially for gaming. ARK notes: As the gaming industry transitions to full-service virtual worlds, video games and social media could merge as consumers socialize and entertain in game-supported virtual spaces, at the expense of physical environments.

According to ARK's research, the convergence between gaming and social media should boost the growth in gaming revenue from 7% at a compound annual rate during the past five years to 10% during the next five years. The report also forecasted a significant rise in value of digital assets. ARK forecasts that global NFT transaction volume will grow more than five-fold from$22 billion today to$120 billion by 2027.

The digital consumer experience and digital leisure is in the early innings. According to ARK's research, global consumers spent 21% of their$31 trillion leisure budget on digitally-facilitated goods and services in 2022. Demand for digital goods and services is likely to grow 17% at an annual rate in real terms, surpassing demand for physically-facilitated goods and services in 2029.

Also: AI improves field service quality and customer experience

Based on the shift toward digital leisure and digital property rights, real digital revenue* should grow 14% at an annual rate during the next eight years, from ~$2 trillion in 2022 to$5 trillion in 2030.

Digital Leisure Is In Early Innings.

Ark InvestDigital wallets are disintermediating traditional banks. Having onboarded billions of consumers and millions of merchants, digital wallets could transform the economics associated with traditional payment transactions, saving them nearly$50 billion in costs.

With 3.2 billion users, digital wallets have penetrated 40% of the global population. ARK research suggests that the number of digital wallet users will increase 8% at an annual rate, penetrating 65% of the global population by 2030.

As consumers and merchants adopt digital wallets, the usage of traditional checking accounts, credit and debit cards, and direct merchant accounts should decline, disrupting traditional payment intermediaries. Cutting out middlemen, digital wallets could facilitate closed-loop transactions for more than 50% of their payment volumes, potentially adding$450 billion to thecurrent$1 trillion in digital wallet enterprise value by 2030.

Also: How to use Apple Pay in stores and online

Digital wallets are gaining share in online and offline transactions. in 2021, digital wallets facilitated 49% of e-commerce transactions, up from 18% in 2016. Since 2016, digital wallets have been gaining share at the expense of credit cards, bank transfers, and cash. In 2021, digital wallets facilitated 29% of offline transactions, nearly double the 16% in 2018. Overtaking cash as the primary means of offline transactions during the COVID pandemic in 2020, digital wallets continue to gain share.

Digital Wallets Are Gaining Share In Online And Offline Transactions.

Ark InvestDigital wallets are scaling faster than accounts at traditional financial institutions. The network effects associated with low customer acquisition costs and a superior user experience are powering digital wallet adoption. After the COVID-induced acceleration and subsequent churn, US digital wallet adoption rebounded in 2022, surpassing previous highs. According to our estimates, US digital wallet users will increase 7% at an annual rate during the next eight years, from ~160 million in 2022 to more than 260 million, while the number of global digital wallet users increases 8% at an annual rate, hitting 5.6 billion, 65% of the global population, by 2030.

Digital Wallets Are Scaling Faster Than Accounts At Traditional Financial Institutions.

Ark InvestOne of the key benefits of digital wallets is that they eliminate middleman by enabling direct payments between consumers and merchants. By enabling in-network transactions, digital wallet providers capture more value per transaction and can share the savings with merchants and consumers. Digital wallets create closed-loop ecosystems for consumers and merchants. After acquiring billions of users, digital wallets (Alipay, PayPay, Block, Kaspi) are onboarding millions of merchants to platforms that enable direct consumer-merchant transactions that disintermediate traditional financial institutions.

Also: The 5 best payment apps

Closed-loop transactions could account for more than 50% of digital wallet payments for 2030. Commonplace in mainland China, closed-loop transactions could disintermediate third-parties and generate nearly$50 billion in cost savings for digital wallet platforms, consumers, and merchants outside of mainland China, potentially adding$450 billion to the $1 trillion in total enterprise value of digital wallet platforms by 2030.

Digital Wallets Eliminate Middlemen By Enabling Direct Payments Between Consumers And Merchants.

Ark InvestThe Big Ideas 2023 report from ARK includes incredible insights across five disruptive innovation platforms, including 14 technology and innovation categories, could scale 40% at an annual rate during this business cycle, from$13 trillion today to$200 trillion by 2030.

Etiquetas calientes:

innovación

Etiquetas calientes:

innovación